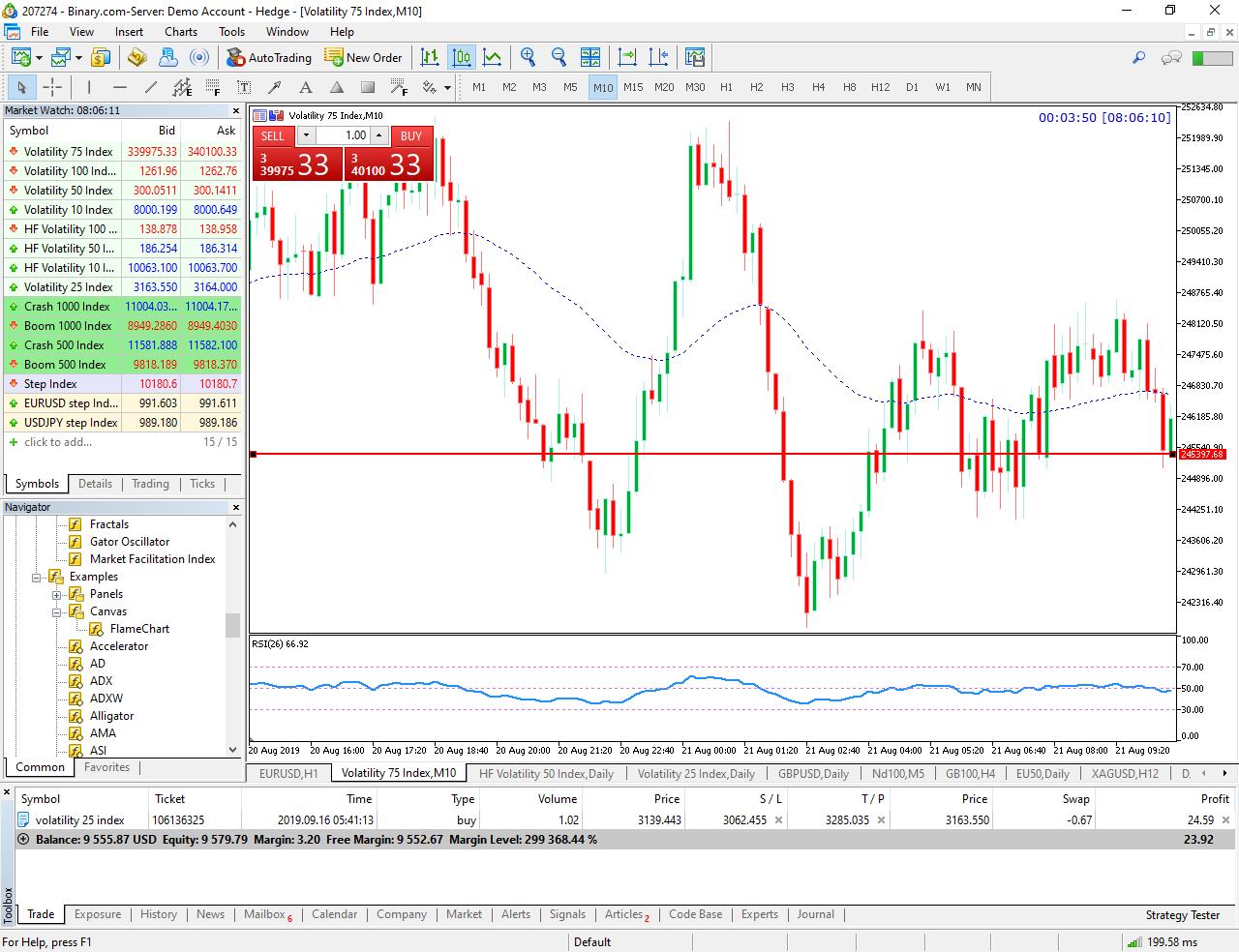

Beanfx volatility index 75 scalper. In a similar manner, products related to the index can also be traded by the use of hints drawn from the index.

My 3 best volatility indicators Traders Bulletin Free

In addition, there are high frequency (hf) volatility indices 10, 50 and 100.

Trading volatility index. The vix futures and options can be used for hedging, or, for trading. Macfibonacci trading system macfibonacci (macd) volatility index 75. The slower prices change, the lower the volatility.

Volatility index 75 trading strategies pdf do you know you can start making money with volatility 75 even as a complete newbie. These move four times faster than the corresponding normal volatility index. Basically, the indicators are moving averages, relative strength index, ichimoku and envelopes.

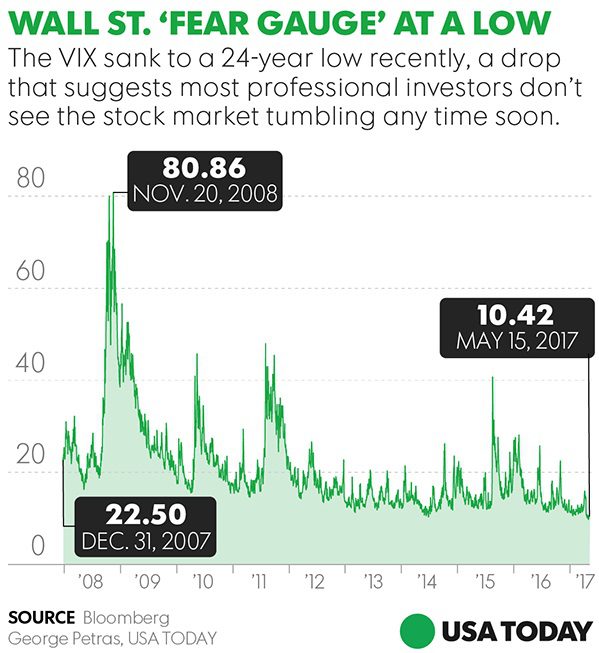

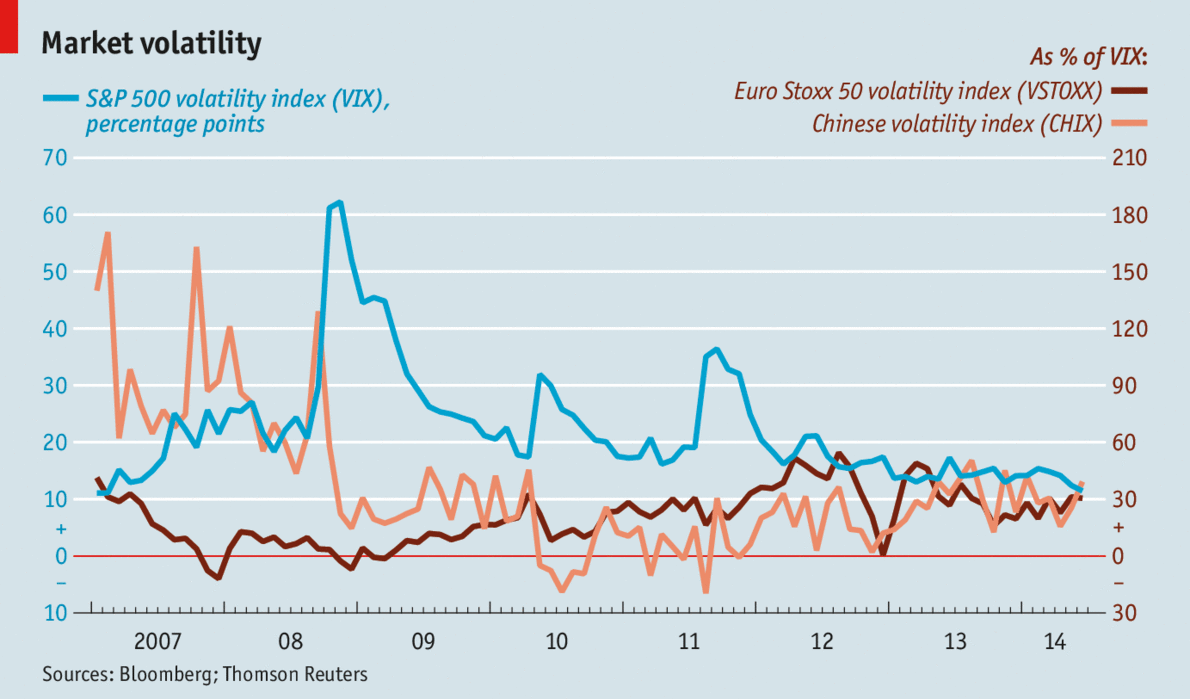

I will show you how it is done in the link below download pdf here. The most popular volatility market is the volatility index (vix) , which is an index compiled by chicago board options exchange (cboe) to reflect the expected volatility in the us s&p 500 market. Since the cboe volatility index (vix) was introduced, investors have traded this measure of.

The vix uses the s&p 500 index (spx) options to forecast volatility for the next 30 days. Thus vix futures (based on the vix index) were created at around 2004 to facilitate trading and hedging of volatility. The beanfx volatility index 75 scalper is a combination of four meta trader 5 indicators.

Trading volatility is an interesting idea, but current etfs and etns do a fairly poor job of it. Throughout this options trading guide, our expert options traders will explain what volatility trading is, how to trade volatility via options, and reveal the best volatile stocks to trade in 2020. The cboe vix index uses s&p 500 index option series to calculate the implied volatility, or expected volatility.

Click here master trader weekly lessons for investors and traders will build your investing and trading knowledge and confidence to profit in all markets! Investors can trade vix volatility index options and futures to directly trade the ups and downs of the market. These notes were based on vix futures (nearest two).

Options trading gives volatility exposure if the volatility of an underlying is zero, then the price will not move and an option’s payout. For example, hf 10 moves 4 ticks faster than volatility 10 index. No matter which direction the market goes, you can make profits by trading the market swings.

The last time this occurred the markets crashed hard back in february 2020. Relative volatility index (rvi) was developed by donald dorsey, not as an independent trading indicator but as a confirmation of the trading signals.it was first introduced in the journal “technical analysis of stocks and commodities” in june 1993. Strategy and account management created:

If history is about to repeat it might be an idea to have a good cash position over the next couple of months. Whereas the volatility index (vix) is an index or a measure of volatility, it can actually be traded as an asset on the stock market. Intro to using the volatility of volatility index (vvix) many people have some knowledge of the vix, the volatility index for the s&p 500.

Features of the volatility 75 index robot. The relative volatility index (rvi) was developed by donald dorsey, who truly understood that an indicator is not the holy grail of trading. With this new script for formulating volatility exposure with a portfolio of spx options, this new method has transformed the vix index from being a concept to a practical standard for hedging and trading volatility.

Can be used on only volatility index 75. Trading with the vix involves buying products that track the volatility index. You either win or you lose.

A brief history of vix Trading the vix involves investing money based on the direction. Sensing a growing demand for retail volatility products, astute finance firms like barclays pushed this concept further by creating a series of exchange traded notes (etn).

Below are the features of the volatility index 75 ea (robot). Vix options and futures are available through the cboe, the same exchange that created the vix volatility. Is equal to the intrinsic value.

Popular trading strategies to trade volatility include the straddle strategy, which can be utilised either with pending orders or options, and the short. Learn the best volatility trading strategies for the options market. Like the s&p 500 index, the vix index, has vix futures and vix options.

According to the volatility index (vix), 2020 has been the most volatile trading year to date. Volatility trading is quite unlike most forms of trading, with the market representing a derivative of another market, rather than a market itself. The aim was to get an annualized expected volatility of s&p 500 index options with an average expiration of 30 days.

The cboe volatility index (vix) measures the market sentiment on volatility. The volatility 10 index market is the least volatile and the volatility 100 index is the most volatile of these. It provides a measure of the expected volatility of th.

Compatible with any vps service. Whether you are trading forex currency pairs or not, when you are tick trading, remember that the outcome is a binary event. The faster prices change, the higher the volatility.

Is history about to repeat itself? It can be measured and calculated based on historical prices and can be used for trend identification. This is an actual screenshot from my phone.

Trading the volatility index (vix). This article will assist volatility index 75 traders on how to scalp quick profits when trading volatility index 75. The rvi is identical to the relative strength index, except it measures the standard deviation of high and low prices over a defined range of periods.

Volatility index trading tips tip #1. Put the vix in your toolbox and the path to being a master trader! As a result, it gains the most during periods of uncertainty and high volatility.

Templates macfibonacci (macd) volatility index 75.

Currency Volatility Chart Currency Exchange Rates

Currency Volatility Chart Currency Exchange Rates

Trade Volatility 75 INDEX awesome 😎 strategy YouTube

Trade Volatility 75 INDEX awesome 😎 strategy YouTube

Volatility infographic Tradeciety Online Trading

Volatility infographic Tradeciety Online Trading

LEAKED Download MAKING MONEY TRADING VOLATILITY INDICES

LEAKED Download MAKING MONEY TRADING VOLATILITY INDICES

Volatility Indices and Forex Trading System Two 2020 YouTube

Volatility Indices and Forex Trading System Two 2020 YouTube

VOLATILITY 75 INDEX CURRENT TRADE EXECUTION YouTube

VOLATILITY 75 INDEX CURRENT TRADE EXECUTION YouTube

NEED A RBR/DBD/PINBAR INDICATOR (MT5) FOR TRADING

NEED A RBR/DBD/PINBAR INDICATOR (MT5) FOR TRADING

VIX Daily Update Volatility Index Edges Slightly Higher

Stock Market Fear at Highest Level in Two Years

Stock Market Fear at Highest Level in Two Years

HOW TO TRADE VOLATILITY, SECRET OF TRADING VOLATILITY

HOW TO TRADE VOLATILITY, SECRET OF TRADING VOLATILITY

Do You Trade Volatility 75 Index? Come Grab This Strategy

Dow Jones Industrial Average 4 Charts Showing Warning

Bond Yields Plunge Triggering Stock Market Rally

VIX Daily Update Volatility Index FlatLines as Stocks Rally

VIX Daily Update Volatility Index FlatLines as Stocks Rally

VIX Volatility Index in the Stock Market 2017 Whats Next?

VIX Volatility Index in the Stock Market 2017 Whats Next?

Volatility Indices Trading System Introduction YouTube

Volatility Indices Trading System Introduction YouTube

volatility indices and forex strategy pure price action

volatility indices and forex strategy pure price action

0 Comments