Make a trading plan and use the one you make…don’t just make one and then never look at it like many traders do. A trading plan in the fx market isn't really any different from any other trading plan you could imagine.

Example Of A Forex Trading Plan Forex Seven Ea Download

Example Of A Forex Trading Plan Forex Seven Ea Download

Traders with a plan will trade better than those without.

Forex trading plan. No matter how good your trading plan is, it won’t work if you don’t follow it. A solid trading plan considers the trader's personal style and. Many traders never even make a trading plan, let alone use one regularly.

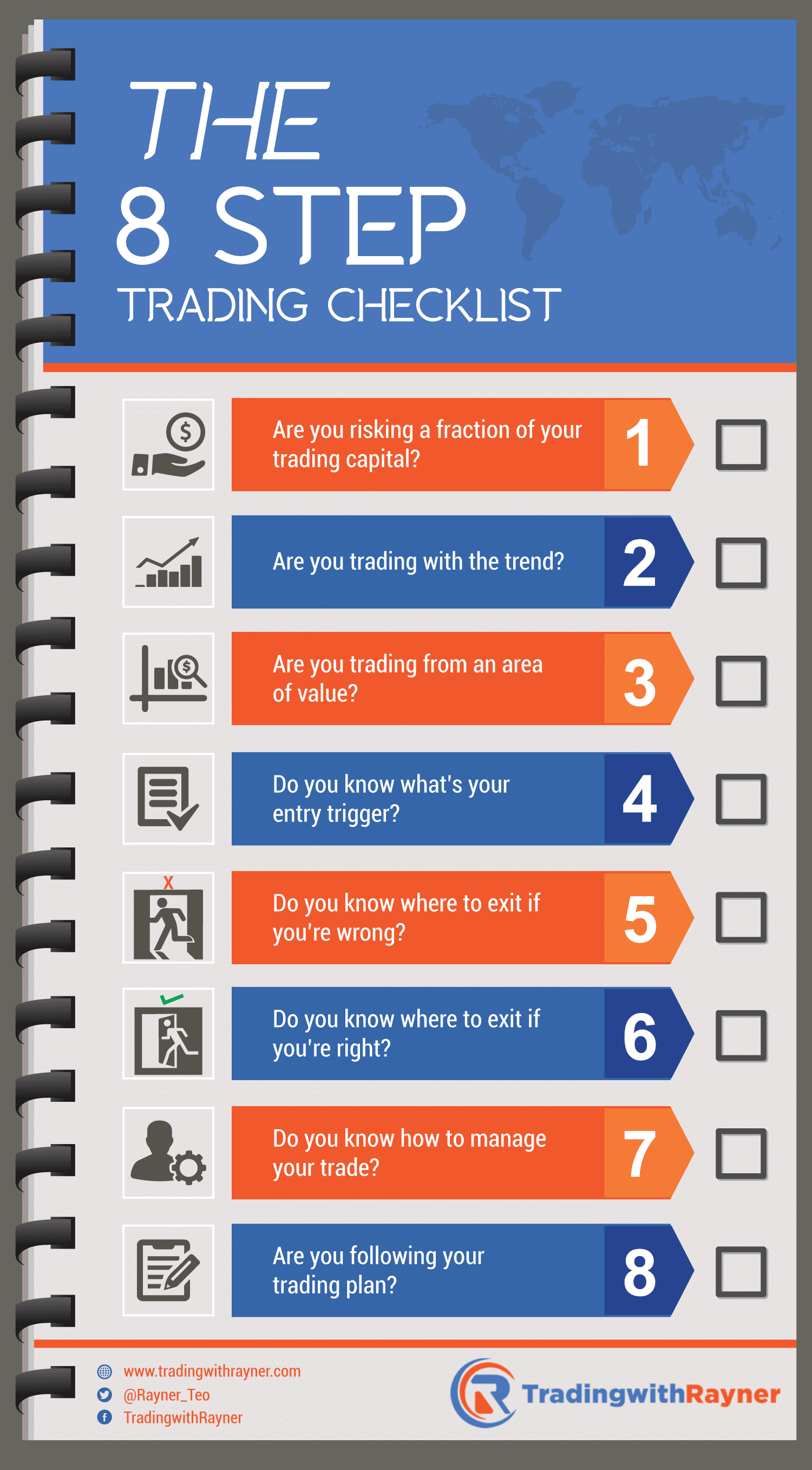

You can use a quick trading checklist beside your computer to make sure each trade you take fits the rules you have created. If you have a good plan (developed over time) and you stick to it, you can become successful! A trading plan is a set of rules that covers various aspects of your trading life.

These plans have information about open trade price levels, technical and fundamental indicators, trader’s goal, plan about the right timing to close a trade. An example forex trading plan: The difference between a trading plan and a trading system.

A trading plan is an organized approach to executing a trading system that you’ve developed based on your market analysis and outlook while factoring in risk management and personal psychology. Forex trading plan is peace of information about the trader’s current market considerations. First, evaluate your expertise when it comes to asset classes and markets, and learn as much as you can about the one you want to trade.

The difference between the winning traders and the losing traders is a plan. Trading forex is very different from every other job in the world because there are no rules. Develop a thorough trading plan for trading forex.

It is all too easy to say “i am going to transform $10,000 into $250,000 in one year trading forex” without having specific details about how what currencies to trade, how often, over what timeframe, and with what risk of loss. The first aspect of your monthly forex trading plan should involve identifying the current market structure, as well as the market structure of the past month. It’s very important that you do both;

A trading system describes how you will enter and exit trades. Each plan should have price alert numbers in writing as well as an entry management criteria in the plan. I recognize that trading is one of the most challenging and rewarding professions on earth.

A trading plan can be defined as a planned method to execute a trading system. Identifying the monthly market structure. Having a forex trading plan is one of the key elements to becoming a successful forex trader.

A trading plan defines your financial goals and how you are going to trade to achieve them. What is a trading plan? How to create a forex trading plan.

There is no one telling you how much to trade. In this post, i will show you exactly how to create a trading plan, even if you have never done it before. The old saying in business “fail to plan and you plan to fail” applies here.

This is because a forex trading plan, for example, will be different to a stock trading plan. Even then the task to write a trading plan often falls into the category of, “i’ll get to it when i have time”. Considering the fact that every decision you make when you trade in the forex market translate to either success or failure, you want to be able to implement a method or a formula that is engineered to minimise the risk.

If you want to trade the forex market, you will need a trading plan to be successful. A forex trading plan must be fully defensible by the larger trends, time frames, and support and resistance levels of the market. But you still have a plan.

The more you dissed variables in the market, the bigger challenge it will pose to your trading account. This is a hypothetical example, the numbers are arbitrary, but you can use this as a template to make your trading plan. But how do you actually create a trading plan for forex trading?

Whilst a trading plan covers your whole trading strategy and the rules you will use overall, a trading checklist can make sure you stay within these rules on each individual trade. To realize your complete potential as a forex trader in the. You may have a simple plan or a complex plan but to be successful you need to follow your plan.

A trading plan is vital to your success as a trader because it gives you a set of proven rules to follow, even when your emotions are trying to make you trade impulsively. The details of your trading plan will be affected by the market you want to trade. A trading plan should be written in stone, but is subject to reevaluation and can be adjusted along with changing market conditions.

Yet unfortunately most traders don’t write one until they’ve blown a few accounts. A trading plan is essentially a framework that guides traders through the entire trading process. There is a fine line between success and failure when it comes to forex trading and a forex trading plan is something that can tilt the scales in favour of one or the other.

These are not the personal details of my trading plan but do reflect the general layout of my trading plan. Education, consistency & persistence, a specific trading plan, proper mindset and the right tools, i will overcome the challenges and succeed and prosper in the financial trading arena. A trading system is part of your trading plan but is just one of several important parts, i.e., analysis.

In the forex trading plan, traders can define their opinion, opportunities. So, if you’re having trouble creating your forex trading plan, or if you want to tweak your existing plan, read on. The forex trading plan serves as a reminder of the best interests for your trading account at any given point in time.

This article will provide you with a better understanding of the importance and uses of a forex trading plan, so that you can use the information to become a better and more successful trader. A trading plan is just like a rule book that includes all the information on how a trader trades. However, after analyzing the markets does not help either.

I welcome the challenge, and through: It sets the conditions under which a trader enters trades, identifies markets, exits trades and. The difference between making money and losing money can be as simple as trading with a plan or trading without one.

A winning forex trading plan should be the starting point for any journey to becoming a consistently profitable forex trader. Before we continue, we have to quickly distinguish the difference between a trading plan and a trading system. Importance of a trading plan.

Sometimes there is a misconception that you need highly evolved market knowledge and years of trading experience to be successful. You may wish to add other components to your checklist as this is just a. Some of the things to look out for in relation to the previous month include various support and resistance zones, trend lines, major pivot zones.

Forex Trading Plan Template, Outline and PDF Checklist

Forex Trading Plan Template, Outline and PDF Checklist

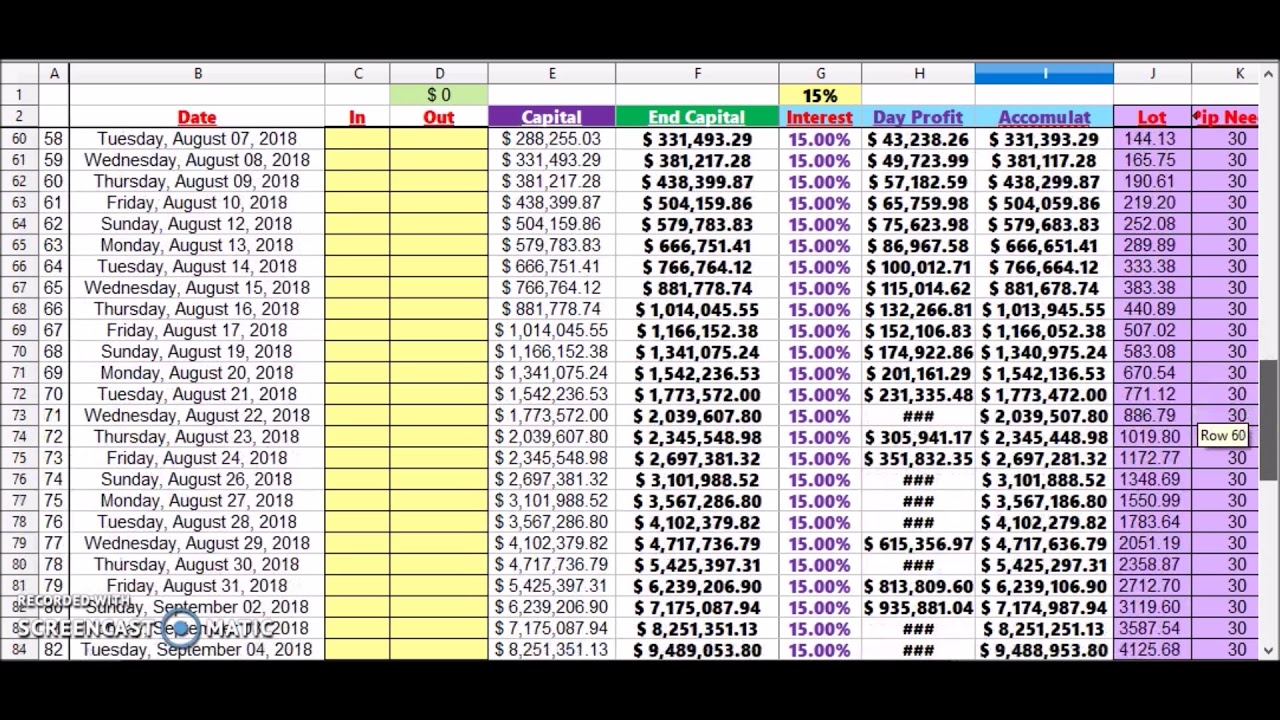

How to make Seven Figures a Year Forex Trading Plan

How to make Seven Figures a Year Forex Trading Plan

The Five Essential Elements of a Good Forex Trading Plan

The Five Essential Elements of a Good Forex Trading Plan

30 forex Trading Plan Template in 2020 (With images

30 forex Trading Plan Template in 2020 (With images

How to create a successful trading plan IG AU

How to create a successful trading plan IG AU

BEST Forex Trading Strategy To Make 1000 per Day in 2019

BEST Forex Trading Strategy To Make 1000 per Day in 2019

Free Forex Trading Plan Template Your Trading Bible

Free Forex Trading Plan Template Your Trading Bible

How to Create a Winning Forex Trading Plan PIPS EDGE

How to Create a Winning Forex Trading Plan PIPS EDGE

Your Own Forex Trading Strategy ForexCracked

Your Own Forex Trading Strategy ForexCracked

30 forex Trading Plan Template in 2020 Option trading

30 forex Trading Plan Template in 2020 Option trading

1415 forex trading plan template

1415 forex trading plan template

Forex Trading Plan Preparation YouTube

Forex Trading Plan Preparation YouTube

Trading Plan In Forex Forex Early Warning Trading

Trading Plan In Forex Forex Early Warning Trading

A Forex Trading Plan Example Pt. I — Euro Fx/U.S. Dollar

A Forex Trading Plan Example Pt. I — Euro Fx/U.S. Dollar

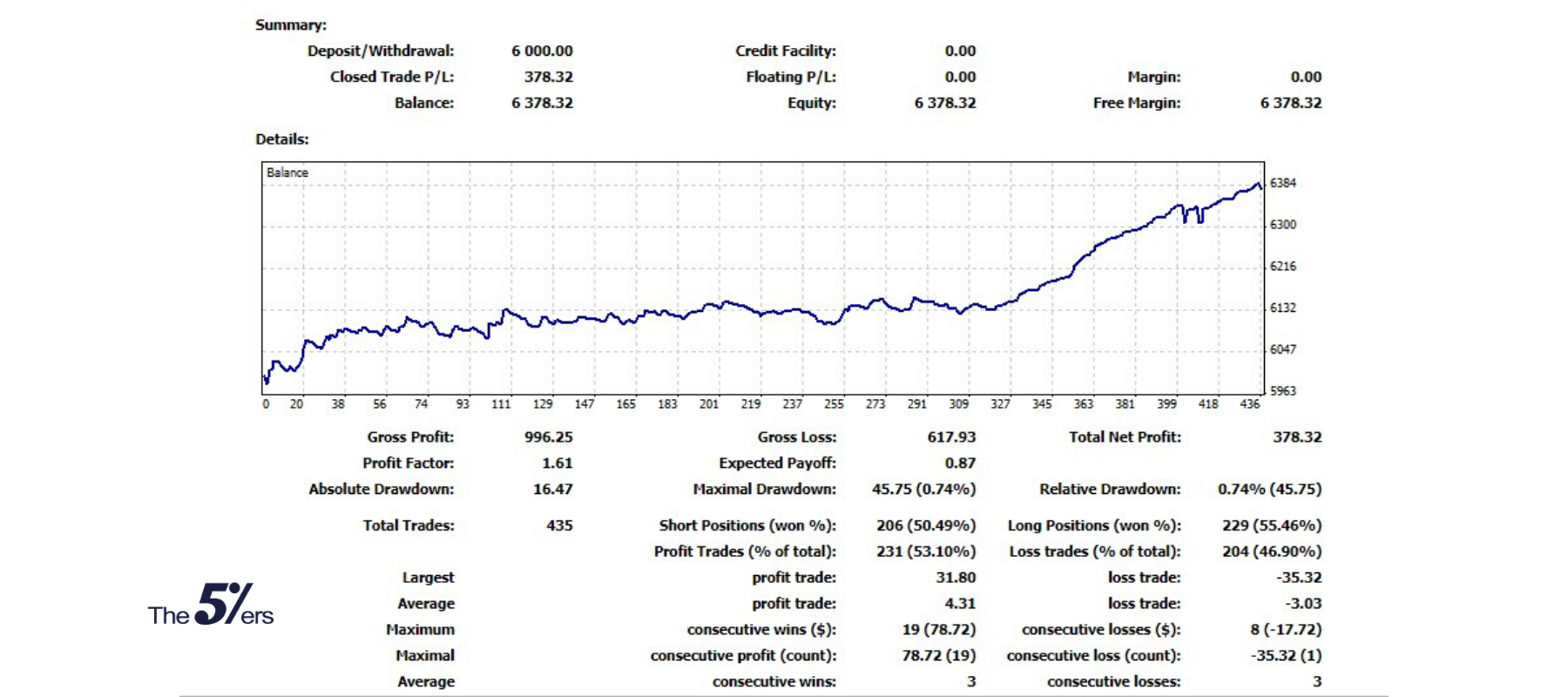

Great Trading Plan to a Forex Funded Trader

Great Trading Plan to a Forex Funded Trader

Forex Trading Plan USD/CAD 5112016 Forex Blog

Forex Trading Plan USD/CAD 5112016 Forex Blog

How to Develop a Forex Trading Plan? Blackwell Global

How to Develop a Forex Trading Plan? Blackwell Global

0 Comments